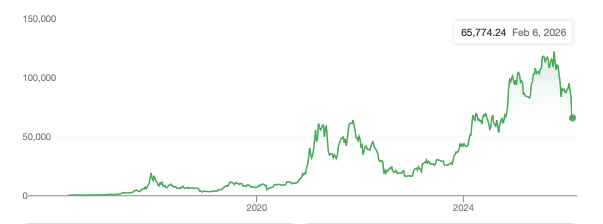

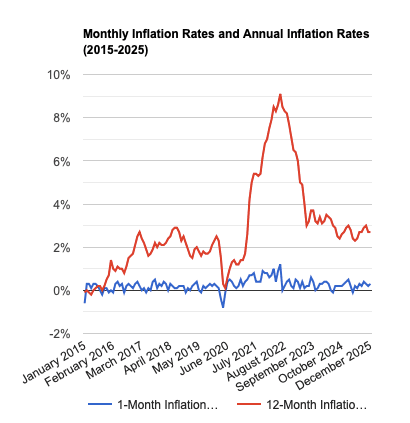

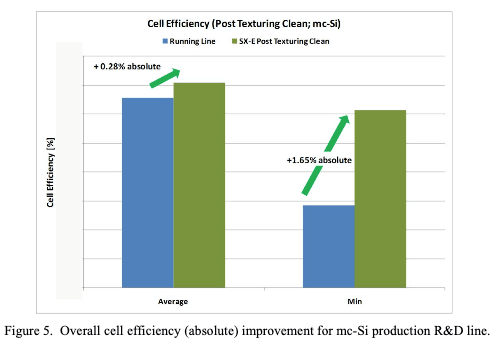

Canada has long-standing economic problems relative to the US, and they have been growing since 2015 as the figure shows (figure from a conservative, Canadian politician, Ryan Williams). These problems infect most of Europe, and will soon extend to the US. They are largely due to a declining birthrate, bad management, and an aging population. The result is a declining Canadian dollar (CAD), rising housing prices, rising national health costs and rising government debt. In both countries, life feels less affordable than in previous years, but the effects hit harder in Canada. Consider, for example, that the average salary in Toronto, Canada’s largest city, is $62,050 CAD. that’s pretty low by US standards, the equivalent of $45,000 US, well below the average salary in Chicago or Houston, two comparable US cities. In those cities the average is ~$63,000 US. Meanwhile rent prices in Toronto are about the same as in Chicago in US dollars, and far above rent prices in Houston. If you wish to buy a home, the price in Chicago is about half that in Toronto. Even with healthcare, life is generally more affordable in the US, and home ownership, though difficult, is not out of reach, especially in Houston.

A main reason that Canadian housing is so expensive is permitting is difficult. Canada has plenty of space for housing, but it’s hard to get a permit to build, and it’s hard to sell the home, too. To be a real-estate agent in Canada, for example, you have to take a year-long course, and pass several stages of permitting tests costing $6000 -$10,000 CAD. In the US, it’s cheaper, about $1000 US and generally it requires only a month-long course. These same regulations also cause salaries to be low, by decreasing productivity. It is hard to start a company in Canada, and hard to retain good workers, since low-productivity workers have rights to equal pay for equal work, with no regard to productivity.

Canadian salaries also suffer from high immigration, particularly of low skill labor. Canada accepts about 500,000 immigrants per year, offering free healthcare and social services. During the Biden years, we accepted 6x more, about 3 million per year, mostly illegally, but Canada has 1/8 the population of the US and more generous benefits. As a result the decrease in affordability has been far greater. In the US and Canada, immigrants have been low skill or unemployed, presenting tough competition for native-born, low-skill workers, and burdening the government welfare system. There has been a push-back in Canada, as in the US, and Canada has begun removing illegal immigrants, as have we in the US. It’s less unpopular in Canada because Canadians see themselves as good no matter what they do. The Canadian population shrank by 0.15% last year, while ours continued to grow. In both countries, lower immigration of unemployed individuals, should lower housing prices, and should protect the welfare system. Of course some businesses benefit from low wage immigrant, and from the unemployed, the social services industry for one, Janitorial services for another. Rich folks are alway s complaining for more immigration because they find it’s hard to get cleaning help, and because they rarely pay taxes at any meaningful rate.

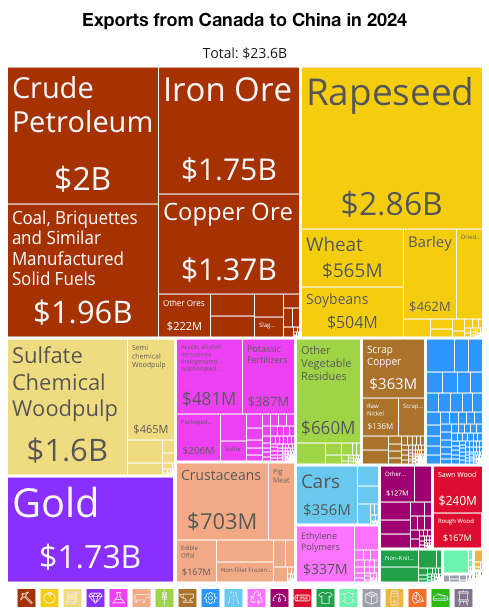

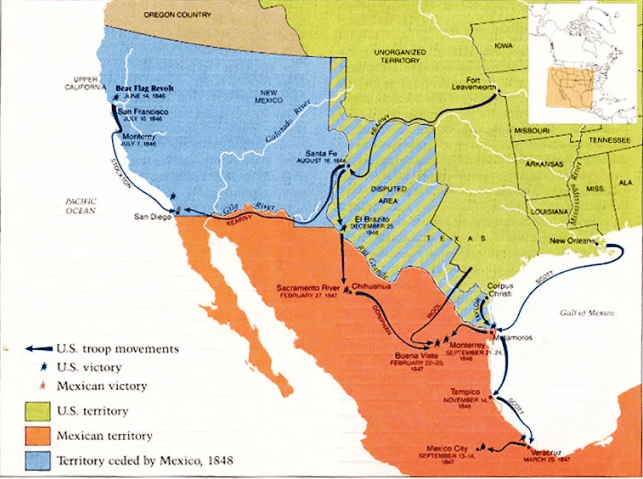

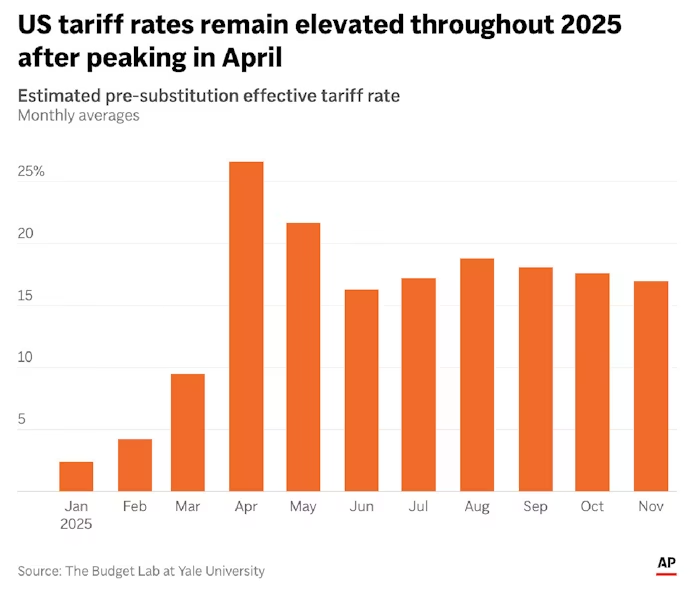

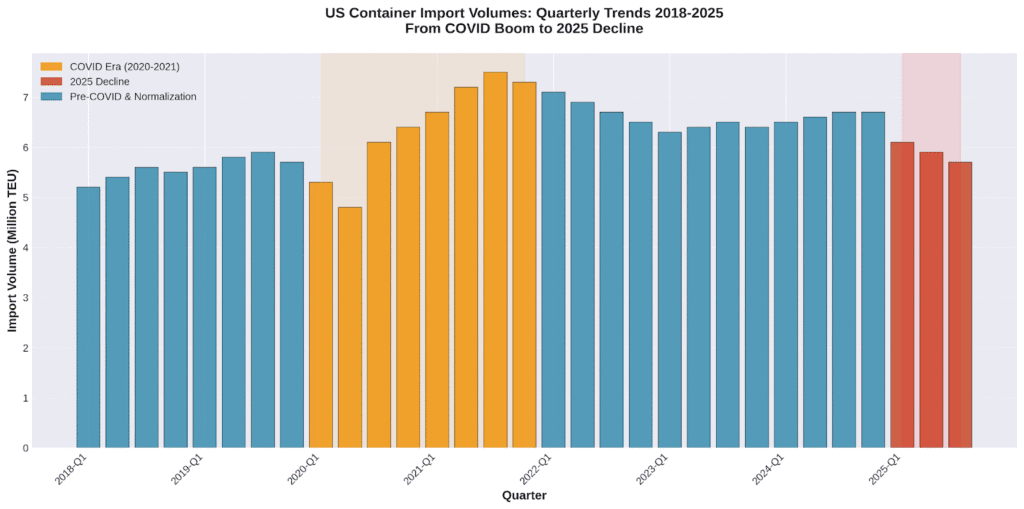

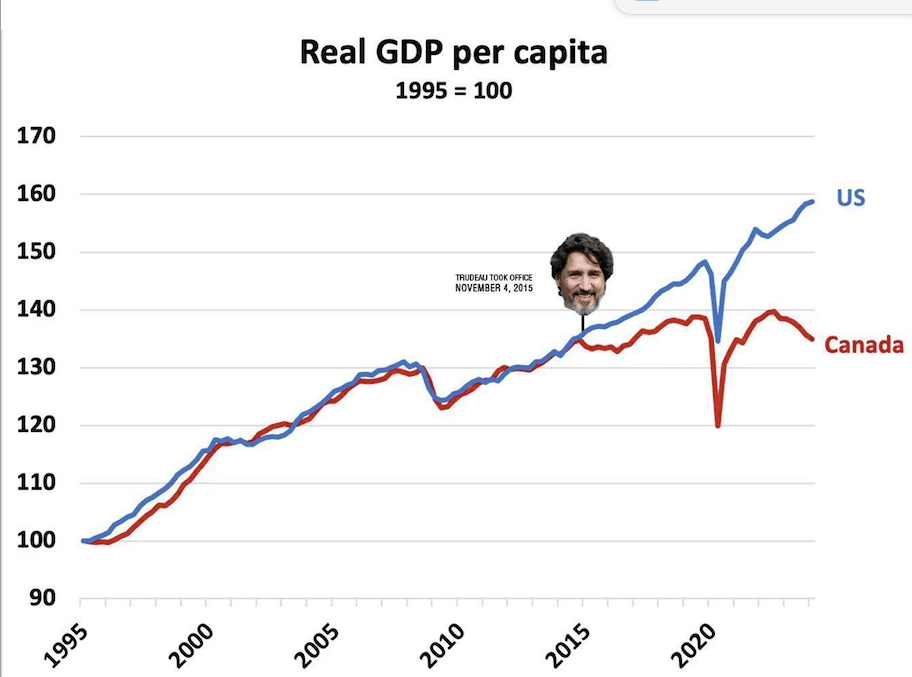

As a band-aide to these economic problems, both in Canada and the US, we have caught to raise government income through a new tax, tariffs. We’ve each put 25% tariffs on automobiles produced in the neighboring country. But Canada has a twist, it can benefit bringing bringing in high-tariff and prohibited imports from China and Cuba hoping the imports cross the border to the US. For example, they import Cuban cigars, and sell them near the border at inflated prices to Americans (largely) who smuggle them to the US. It worked too during prohibition for whiskey. In the last month, Canadian PM Carney reduced the tariff on 50,000 China-made EVs to 6.1%. If large numbers find their way to the US as new or used vehicles, the hope is that Chinese companies will buy manufactured goods from Canada, or evenest up manufacturing. It might work, though Cuba never set up cigar manufacturing in Canada. Typically Chinese companies send abroad nearly finished items, allowing the host country to add finishing touches that involve no technology but that can be claimed to raise the value significantly to avoid taxes. As the chart above, China imports from Canada are virtual all raw goods: food, petroleum, iron ore, gold… Technological expertise stays at home. Canada will need a home grown engine to get out of its funk.

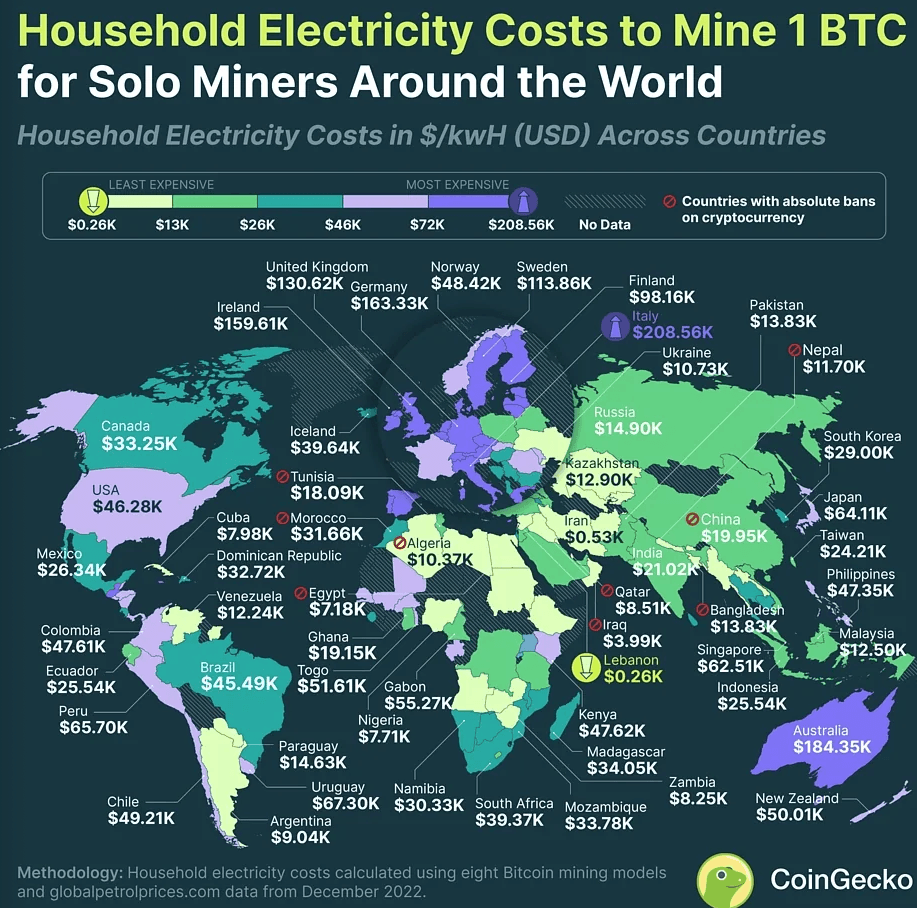

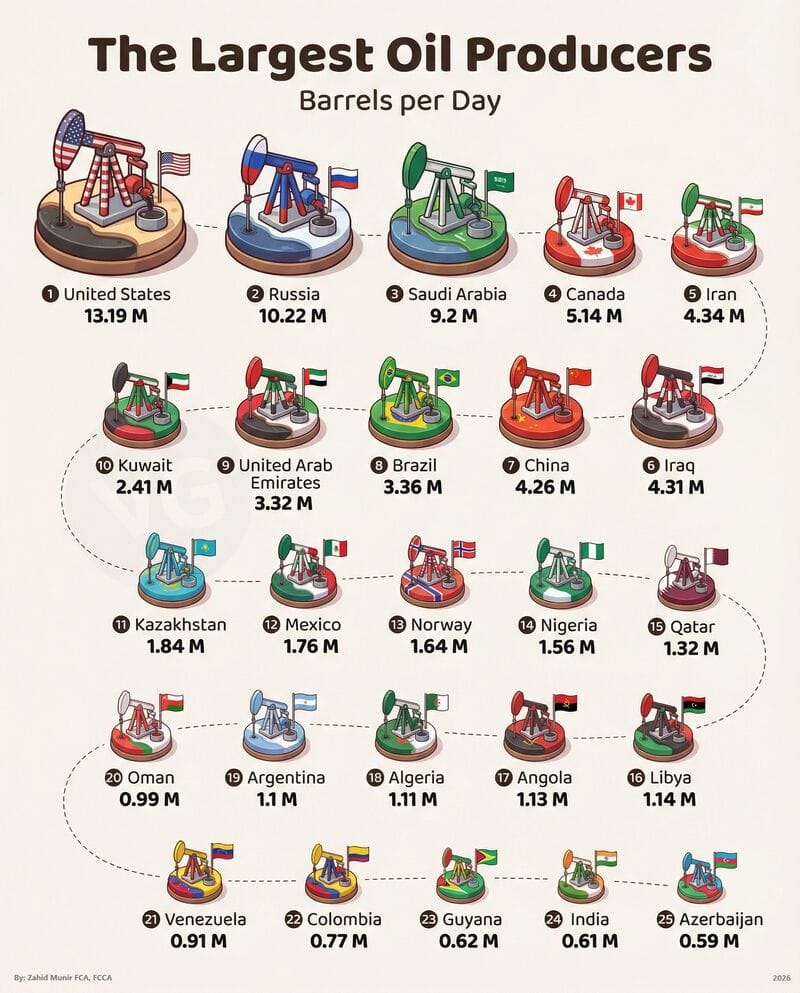

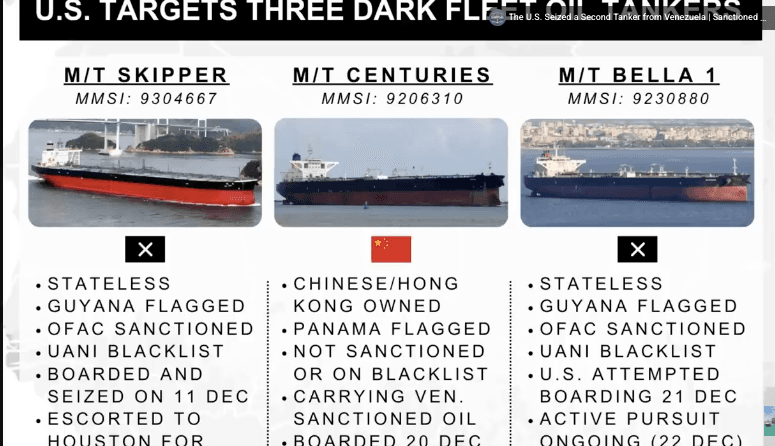

At this point, the most likely home-grown engine is likely to be oil. Canada has oil, and the world needs it, especially China. Currently the Straight of Hormuz is effectively closed because of the war. Many countries are being hurt by this, but particularly China because of troubles in three of its major, sanctioned suppliers, Iran, Venezuela, and Russia. China will need a new source of oil, and will likely pay Canadian prices if the Canadian government can see through to provide infrastructure for export. Selling to China could also avoid a war.

Another thought, both to benefit Canada and the US, I’m pro-immigration, but suggest we target hard working, honest immigrants with usable skills: plumbers, cooks, programmers, cement workers … people who are unlikely to start out on welfare, and likely to provide a decent middle class lifestyle. The children from these immigrants integrate well in the US, and likely will into Canada. They integrate far better than the children of unskilled violent refugees. I also favor tariffs, especially on manufactured and luxury goods, like cars and wine. It provides government income, and promotes technical skill at home.

Robert Buxbaum, March 10, 2026.