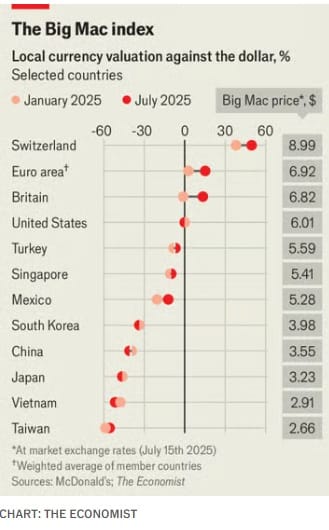

One can buy a new electric car in China for US $20,000, roughly half of what it would cost in the US. Similarly, a good phone is cheaper in China, or clothes, or a Big Mac. A McDonald’s Big Mac in China costs, effectively $3.55, 59% of what it costs in the US, slightly less than 3/5 the US price. The Chinese explanation is that China is nearly twice as efficient as the US at most every type of manufacturing. I don’t believe this explanation, though there is some truth to it: Their electricity is cheaper, in part because they burn mostly coal for electric power. Meanwhile we have shut-down our coal plants, and have hardly built nuclear since the 1970s.

Another source of efficiency is that China arranges its manufacturing into dedicated cities for different products, one city for toys, another for luggage, others for cars, planes, hair driers… This helps efficiency but I’m not sure how much, and I don’t see these advantages applying to McDonald’s. There is no way I believe their workers are 5/3 as efficient as US workers when it comes to making burgers. It’s not like they ship the burgers from a central factory, and they buy gain and meat from us. My sense, then, is that it’s not efficiency that keeps prices low, but that the Chinese currency, the yuan is undervalued.

It’s hard to estimate how much their currency is undervalued, but I will use the burger-metric, above and say the yuan selling for about 3/5 its true value, and that this explains most of why Chinese shoes, cars, and clothes are so cheap. The rest of the price difference is efficiency, I’d guess. China isn’t the only country with an under-valued currency; Japan’s currency seems even more undervalued. Similarly India, Taiwan… The China is a bigger economy, though, and correcting the Chinese GDP by 5/3, I find their economy is yet bigger, about 111% as big as ours. By a similar correction, European economies appear smaller than they are given credit for.

China’s undervalued currency helps propel its growth, I think, and provides us with cheap goods, but our industry suffers. Also troubling, China will likely surpass us militarily in 3-5 years. One way of slowing this is through tariffs. Trump’s tariff formula, as I understand it, was designed to preserve some China trade, allowing US consumers to benefit, but also taxing the exchange. I think this is a good idea.

Another proposal is to lower the US interest rates. Currently our prime interest rate is 6.5% while China’s is 3%. This provides an incentive for the Chinese industry to invest in the US, maintaining its undervalued currency. The benefit isn’t quite as large as it might seem since we have a 2.7% inflation rate and China has a 0.7% inflation rate. Correcting for this, our bonds return an effective 3.8% and Chinese bonds return 2.3%. The difference is about 3/5 similar to the mismatch in our currencies. Trump has been pushing the Federal Reserve to lower our interest rates, and The Fed has grudgingly agreed, slowly. A lower interest rate would also spike US industry and inflation, and help reduce the government deficit. Trump has also proposed new ships for the navy. Too little, too late, I think. Things should get dicy in the next decade between the US and China.

Robert Buxbaum, December 30, 2025. I started this post not knowing where it would lead. As I research and write, I learn. Perhaps you will too,