The wealth of the mean American household has dropped since 2007, a result of de-industrialization, and unmet expectations. On average, America is richer, but we’ve increased the economic divide. The richest have left behind the working and bourgeoise classes. Though we are beginning to come back, with home ownership rising, a particularly nasty legacy remains, especially among black families. Some 47% of black families have no liquid savings — a far greater fraction than in 2007. This. has to change if black folks are ever to get ahead as a group.

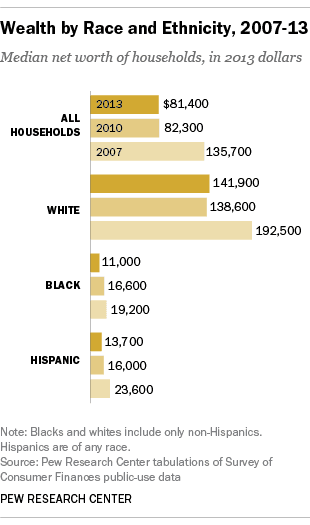

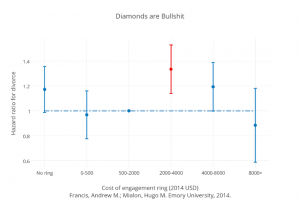

College graduation rates have increased among black students, and black salaries, but I’m not sure the degrees are in productive fields (true for white students too). As of 2015, 22.5% of black students and 15.5% of Hispanic students had completed four years of college. That’s less than the 36.2% of white students, an inequality, but not a horrible one. As of 2013, the average salary of a black college grad was over $1000/week, somewhat less than the average for white grads, but enviable compared to the world as whole. The big problem I see is that black workers save very little compared to other ethnic groups, or compared to previous savings rates as shown by the graphic below. By 2013, the net worth of the median black family (savings, plus paid-off part of home and car) was $11,000 (Pew Research Data, below), down from $19,200 six years earlier. This is much lower than the net worth of white families (also down since 2007). In terms of liquid savings the mean is near zero, and this is the mean. Half of all black families are doing worse.

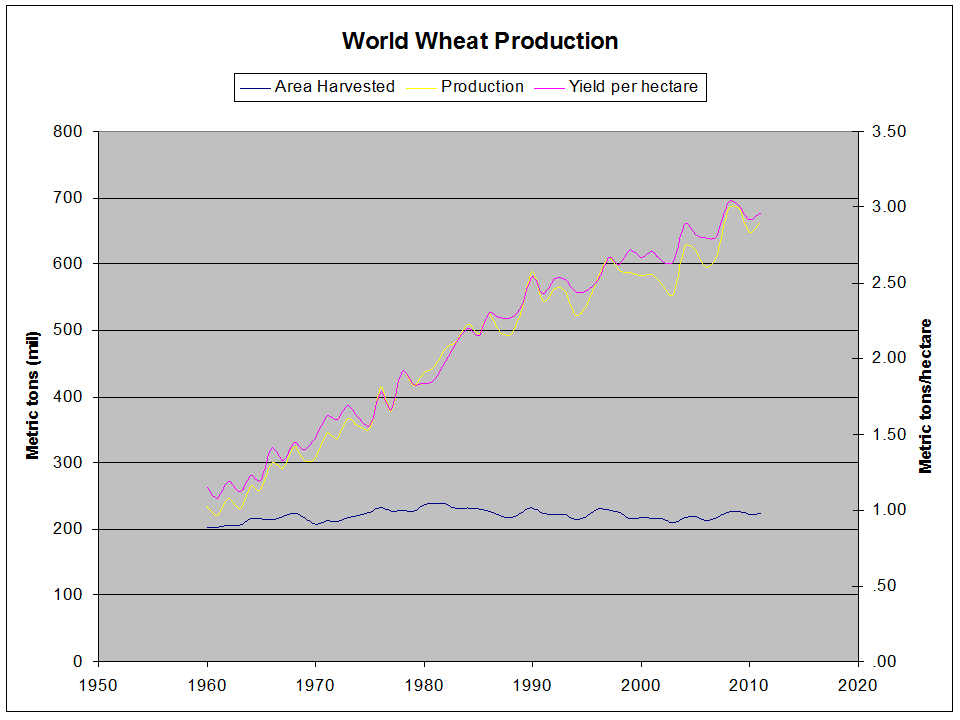

Net worth disparity 2007 – 2011. Black folks are doing poorly and it’s getting worse.

The combination of low savings and low net worth puts black folks at a distinct disadvantage to their condition six years earlier. Without savings, it is near-impossible to weather the loss of a job, or even to fix a car or pay a ticket; a major disease is basically a one-way ticket to the welfare office. Six years ago, when people saved more and prices were lower, problems like this were annoyances. Now, it’s a family disaster.

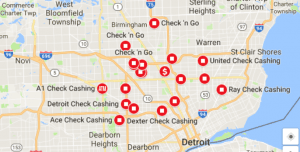

A person without savings will not have a savings account or a checking account. As such, he or she will not have a credit card or check cashing privileges. The only way to cash a check will be via a for-fee service, and these tend to come at a steep cost (2-5%). The growth of check-cashing services in black neighborhoods is a symptom of this. People with savings accounts cash checks essentially for free, and can usually borrow money by way of a credit card. Black people and poor whites tend to use debit cards instead. They look and work like credit cards, but they incur fees upon use, and do not provide instant loans. When black folks and poor whites need quick cash, their options are the loan-shark or the pawn shop: high-cost options.

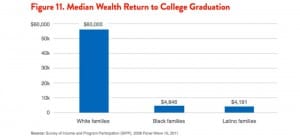

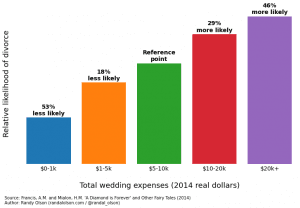

While black individuals have lower incomes than whiteindividuals, most of the blame seems to be family stability. Employed, college-educated blacks earn, on average, 95% as much as employed, college-educated whites — not great, and I trust that will improve. The bigger problem is not being able to show up for work because of family instability., Single-parent families are significantly more common among black folks. Roughly 40% of black families are single-mother, or mother+grandparent households compared to “only” 26% in the population generally. In both populations, the number of single parent households have increased dramatically in the last few years, a result I suspect of the government’s desire to help. The government gives more aid to a split-up couple than to one that stays together, but the aid brings with it long-term damage to net worth. A family with one parent will naturally have a lower-income and savings rate than a family with two. The lack of stability that comes from a single parent family, I suspect, has contributed to crime, births out-of-wedlock, and the tendency of black folks to drop out of college.

Black families don’t benefit much from college –in part a result of course choices, in part the result of borrowing. (Forbes, 2015).

Some white do-gooders want to eliminate check cashing businesses and pawn shops in a misguided desire to help the low-income neighborhoods, but the success of these companies tell me that they are needed. Though check services and pawn brokers take a nasty bite, urban life would be much worse without them, I suspect.

Another so-called solution of the do-gooders, is to tax savings and transfer the wealth to the poor. This form of wealth redistribution has been a cornerstone of the Democratic party for the last century. The idea of the tax is that it will transfer “idle wealth” from rich savers to poor folks who will spend it immediately. The problem is that great swathes of the nation don’t save at all currently; net worth is down all across the US — among white and black families both. Taxing savings will almost-certainly reduce the savings rate even further. Besides, savings are the stuff of self-determination and dreams — far more than spending, it is savings that allows a person to start a new business. One does not provide for the dreams of one group by taking them from another — particularly when the merit of the receiving group is that they are immediate spenders. The danger of this is seen by looking at Detroit.

As it is, inner city children do not see a path out via education. Detroit school attendance hovers around 50%, and business startups are lacking. With higher savings rates and higher family stability, folks could start businesses, and/or take advantage of job opportunities that come along, and that would help the community more than redistribution. It sometimes seems that the only successful businesses in Detroit are check cashing, pawn brokers, churches, hair-salons, fast food, and medical marijuana — businesses that provide little community return. Detroit has lost its manufacturing center, and now has more medical marijuana providers than groceries — a sad state of affairs.

The Check cashing services of south-eastern MI are concentrated in poor black and white neighborhoods.

In 2016, both presidential candidates touted major building projects to help the inner city poor. In principle this could help, but the inner city youth lack the training or licenses to build roads and bridges. They have barely the math skills to manage a McDonald’s. For another thing, many of the project aren’t needed. They’re form of income redistribution and graft. Surely we can do better. Trump makes the case for tariffs (reducing free trade) as a way to rebuild the industrial base of cities like Detroit. It’s an approach with merit, I think. He’s also and has suggested closing the border to low-wage workers. This is expected to raise the price of California lettuce and NY hotel stays, but it’s likely to increase employment and wages among lower-skilled, black and white Americans. Small steps, I think, to solving a serious problem.

One more thing: open a bank account if you don’t have one. Mine is at a credit union. I opened it with $5, and opened a checking account at the same time. Have your wages deposited automatically, if you can. And avoid the check cashing services. Let your savings grow.

Robert E. Buxbaum, April 21, 2017. I ran for water commissioner 2016 (Republican) and lost. If you find my comments insensitive, that could be why I lost.

Like this:

Like Loading...