Canada’s healthcare is free to the user. It’s paid for by taxes, and it includes a benefit you can’t get in the US: free, doctor assisted suicide, euthanasia. This is a controversial benefit, forbidden in the Hippocratic oath because it’s close to murder, and includes the strong possibility of misuse of trust. Assistance by a trusted professional can be a bit likes coercion, and that starts to look like murder — especially since the professional often has a financial incentive to see you off.

In 2021, according to Statistics Canada, Canada assisted the suicide of 10,064 people, 3.3% of all Canadian deaths. There were about 4,000 more, non-assisted suicides. In Quebec, the Canadian Provence where Medical Assistance in Dying (MAiD) is most popular, 5.1% of deaths result from MAID. The Netherlands has a similar program that results in 4.8% of deaths. In Belgium, it’s 2.3%. These countries’ suicide rates are far higher than in the US, and account for far more deaths, per capita than from guns in the US. My guess is that suicide is common because it is free and professional. It’s called “Dignity in Dying,” in Europe, a title that suggests that old folks who don’t die this way are undignified.

In Canada, about 80% of those who requested MAiD were approved. A lot of the remainder were folks who died or changed their mind before receiving the fatal dose. If you attempt suicide on your own, it’s likely you won’t succeed, and you may not try again. With doctor assisted suicide, you’re sure to succeed (even if you change your mind after you get your lethal shot?)

In Canada you don’t have to be terminally ill to get MAiD, you just have to be in pain, and extreme psychological pain counts. Beginning March 17, 2024, depression will be added as a legitimate reason. According to Canadian TV news, depressives are lining up (read some interviews here). Belgium and Netherlands allows elders to be euthanized for dementia, and children to be euthanized on the recommendation of their parents. France passed similar legislation, but the doctors refused to go along, see cartoon. I applaud the French doctors.

There have been persistent claims that Canadian doctors and nurses push assisted suicide on poor patients, telling them how much bother they are and how much resources they are using. There has been an outcry in British and American newspapers, e.g. here in the Guardian, and in the NY Post, but not in Canada, so far. Rodger Foley, a patient interviewed by the NY Post, recorded conversations where his doctors and nurses put financial pressure on him. “They asked if I want an assisted death. I don’t. I was told that I would be charged $1,800 per day [for hospital care]. “I have $2 million worth of bills. Nurses here told me that I should end my life.” He claims they went so far as to send a collection agency to further pressure him. In another case, a disabled Canadian veteran asked for a wheelchair ramp, and was told to apply for MAiD.

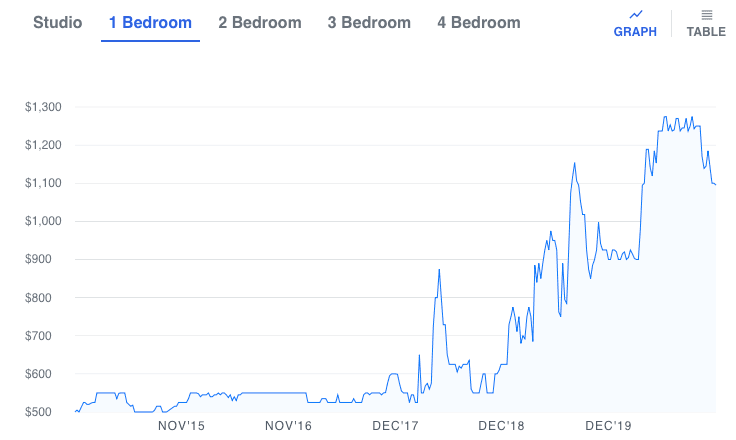

Even without outside pressure, many people seeking MAiD often cite financial need as part of the reason. A 40 year old writer interviewed by Canadian television said that he can’t work and lives in poverty on a disability payment of just under $1,200 a month. “You know what your life is worth to you. And mine is worthless.”

The center of the argument is the value of a person in a social healthcare state when their economic value is less than the cost of keeping them alive. Here, Sabine Hossenfelder, an excellent physicist, argues that the best thing one could do for global warming and ecology is to have fewer people. Elon Musk says otherwise, but Ms Hossenfelder claims this only shows he is particularly unworthy. There’s a Germanic logic here that gave us forced euthanasia in the 1940s.

I find euthanasia abhorrent, especially when it’s forced on children, the elderly, and depressed folks. I also reject the scary view of global warming, that it is the death of the earth. I’ve argued that a warm earth is good, and that a cold earth is bad. Also, that people are good, that they are the reason for the world, not its misfortune. It seems to me that, if suicide aid must be provided, state-funded hospitals should not provide it. They have a financial incentive to drop non-paying, annoying patients. That seems to be happening in Canada. A patient must be able to trust his or her doctor, and that requires a belief that the doctor’s advice is for his or her good. Unfortunately, Canadian politicians have decided otherwise. I say hurray for the doctors of France for not going along.

Robert Buxbaum, April 25, 2023. The medical profession is shady even when you pay for services, see Elvis Presley’s prescription. There’s always a financial interest. Even based on old data, the US is not a particularly high-murder country if suicide is considered murder.