As things stand, the major export of Germany to the US is high end cars: Mercedes, Audis, Porsches, BMWs, $100,000+ on average. The lower end models are made in the US, Mexico, and Canada. These high end cars are the biggest profit centers of their makers and of the German economy. Currently, they face an import tax (tariff) of 15%, the same as everything from Germany (or Italy or Japan). Liberal economists are furious at this; they claim it’s a tax and that it is inflationary. They are right on both counts except that this is only a tax and inflationary for the few Americans who buy new, high end cars.

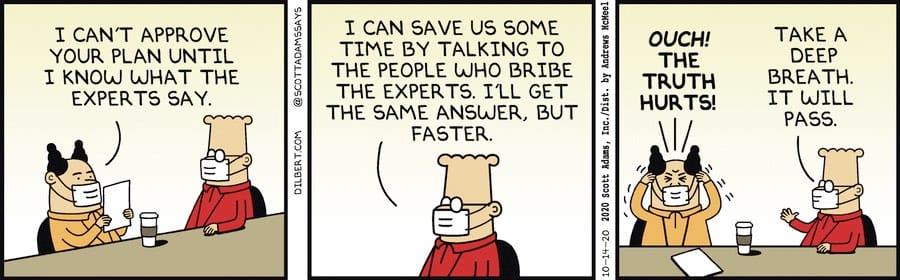

The Americans who buy such cars are typically rich folks — poor and middle class folks can’t afford them. They are also folks with ‘taste’, folks who need a BMW, and would not be caught dead behind the wheel of a US car. Normally liberal economists would favor taxing such people, but these are often the who hire economists. They run the TV programs and newspapers, universities and hedge funds. They choose the economists and the economists are eager to see things their way.

Another high tariff item imported from Europe is art. Modern art for $1 million dollars that ends up in museums. For the average Americans the tariff on this, or on art is irrelevant or beneficial. The income it generates is used to offset other taxes, allowing Trump to remove the tax on tips, for example. That this tariff falls on rich people and replaces a tax that otherwise fell on poor workers. Liberal economists should favor of this, but their opinions are not their own.

A side benefit of these tariffs for ordinary folks, is that that they cause some buyers to switch to American-made products, cars and art. Perhaps not for themselves, but for for their children. They may buy a German car made in the US, rather than one made in Germany, or art from an American. This provides jobs for US workers — and an opportunity for Detroit to retool for the future. Detroit auto workers seem to understand this; they voted for Trump in 2016 and 2024. Detroit’s union leaders opposed tariffs. In Michigan, the union leaders get their power mostly from MI politicians, Democrats, who force union membership.

This is not to ignore the suffering of those who buy foreign products, the buyers of new BMWs, or French cheese, or high end art. As things stand, Columbian coffee is tariffed at 10%, and that may add 50¢/lb. Mexican coffee is not taxed, but many average Americans prefer Columbian. I hope they can be consoled by Trump’s tax breaks.

Some months ago, Trump showed off a tariff schedule that he considered ideal, with rates targeted to reduce our trade deficit by half. I derive here, Trump’s formula and rates, and give my opinions of the target. By the formula he presented, the EU tariff should be higher than it is, 20%. Trump has it at 15%, I think, for diplomatic leverage, to goad the EU into lowering their tariffs on us goods, now 15%. He’s also pushed them to spend more on defense, and pushed to end the war between Cambodia and Thailand. He threatened them with near 100% tariffs if they didn’t stop fighting.

Robert Buxbaum, September 2, 2025. Here’s a Bob Dylan song, union sundown, making a musical case against free trade. Once upon a time that was a liberal view. Now not. The NY appeals court ruled to block Trump’s tariffs to stop the horrible damage being done. My guess is the judges drink high-end coffee, eat French cheese, and drive new, German cars.

Pingback: Tariffs raise $30 billion per month, but haven’t affected inflation | REB Research Blog

Pingback: The shutdown will drag; we will win | REB Research Blog