Last night a CNN reporter was going around a Trump rally asking ‘When was America ever great?” It’s a legitimate question for anyone wearing a MAGA hat. “Make America Great AGAIN” suggests that America was once great and is no more. The answer the reporter pushed for, I think, was the one given by NY’s Governor Cuomo: “America was never that great.” Alternately, the answer of Michelle Obama, who claimed in 2008, “For the first time in my adult life, I am really proud of my country.” The attendees attempted other answers, like 1776, but the reporter shot them down, saying that people were enslaved in 1776, and telling the home audience that even later, women didn’t have the right to vote, or the LGBT community was denied the rights to which it was entitled. I was not there, and might have got shot down too, but I suspect the question deserves an exact answer: the last time America was great was just before October 24, 1945, United Nations Day, the day we submitted to be part of a world government.

By October 23, 1945 WWII was over. We had peace and plenty, the most powerful military, and the most powerful economy. Besides this, we had a baby boom (Children are a bedrock of success, IMHO). Also, on October 23, 1945, the Brooklyn Dodgers signed Jackie Robinson, the first black, major Leaguer since the late 1800s. We thus took a major step against the greatest of our original sins. These were aspects of US greatness, but they were were not guaranteed. They were based on two pre-requisites: a national dedication to self-improvement, and the sovereign control we had over our self-improvement. Total control ended on October 24, 1945 when we joined with the Soviet Union, the United Kingdom, China, France, and several other nations accepting (limited) control by the United Nations organization.

By accepting United Nations oversight, we gave over a significant chunk of sovereignty to other countries whose desire, mostly, was that the US should not be greater than them, and largely that it should not be great at all. To that end they endeavored to insure that we did not have the most powerful economy, the most powerful military, or a baby boom. From tat day on, other countries would sit in judgment on our behaviors and goals. More and more, they would demand remedies that served their interests and diminished US greatness, its exceptionalism. To the patriot this is a disaster. The New York Times declares that anti-exceptionalism is the road to world peace and prosperity. The MAGA crowd disagree.

It’s not that the MAGA Republicans are against world peace or prosperity. No sane person is, but they claim that the best way to achieve these things is for us to be exceptional and work in our own best interests. It is only a sad peace that is achieved by having a foreign body decide that we are at fault in every conflict, and that we should pay reparations to all who lag. There are many poor, socialist countries choosing judges, and these judges tend to rule that the US, as a rich nation, is always at fault and should always pay — both for “development” of the poor nations -overseen by them — and for the the UN too. We knew that their judges would rule this way, but likely didn’t care, or realize how much of our greatness rested on sovereignty. Without sovereignty, even the greatest of world powers will be brought down. Alger Hiss, the person Truman handed the signed UN charter to, was a spy for the Soviet Union. It was a telling beginning.

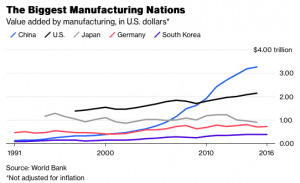

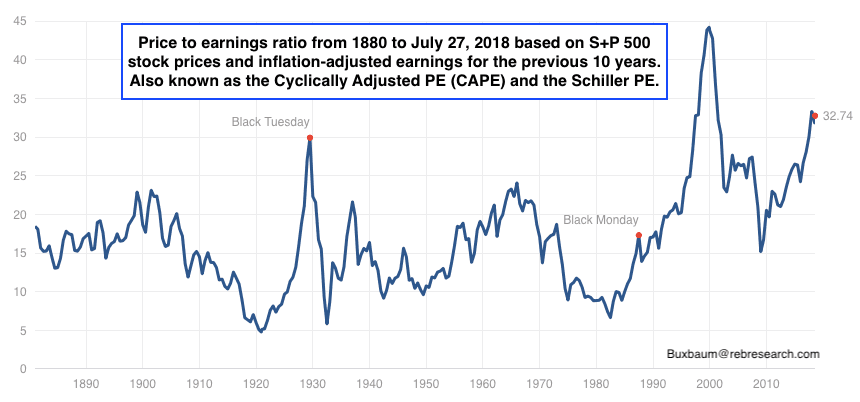

One of the big promises of Donald Trump is that he will limit the reach of the UN and of its ability to reach into our pockets. He already renegotiated or rejected trade agreements, like TPP that would have sent our jobs and technology abroad. Trump also placed import taxes (tariffs) on some foreign goods. The MAGA folks approve, but the Obama internationalists are scandalized. As depicted in the book “Fear”, long time (Obama) staffers at the White House stole tariff bills from the president’s desk to save the world by keeping them from Trump’s signature. Tariffs have been used throughout American history, and can be a benefit for jobs, and diplomacy and for American manufacturers. They are not radical, but some people lost out. Larely, those were US consumers of foreign goods who suffered. Things improved most for black and hispanic workers though. The intellectual class who claim to represent black and hispanic interests have removed Trump and supporters from social media. It’s their way of winning the argument.

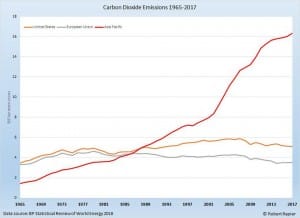

A major anti-MaGA goal is to stop global warming. This is done by globe-trotting folks in private jets who’ve agreed we should shut US industry and pay $1B/ year, while permitting unlimited coal use by China and India. They were the largest CO2 sources, and also among the least efficient producers.Their share of CO2 output is huge and growing. The globe-watchers don’t care. By the way, is a cold world is something we really need?

Trump also limited the power of the world trade organization and of the world court. It’s something that Henry Kissinger recommended In the Journal “Foreign Affairs 2001. Kissinger wrote that “The danger [in too much power for the world court] consists of substituting the tyranny of judges for that of governments; historically, the dictatorship of the virtuous has often led to inquisitions and even witch-hunts.” Trump also built up the military, and claims he will eliminate a postal agreement that gives low, subsidized rates, to China and poor countries so they can mail goods to the US for far less than we can to ourselves. Joe Biden has pushed for “the dictatorship of the virtuous” and promises to raise taxes to pay for it. He’s also suggested packing the supreme court. To me, this is far more radical than tariffs.

The MAGA divide between Trump and Obama/ Biden is not new. It’s existed to a greater or lesser extent between most Democrats and Republicans as far back as the civil war. One major cause of the civil war was tariffs. Then as now, tariffs benefit the manufacturer and worker, and hurt the aristocrat.

In 1918, the MAGA divide played flared because of Wilson’s support of the League of Nations. Republican, Henry Cabot Lodge opposed joining the League of Nations over the same complaints that Trump has raised. Trump’s MAGA claim is that he’ll make US agreements serve US interests. Also that he’s making the US military strong again, and making the US economy strong again. For all I know, the plan for the next four years is to try to ignite another baby boom, too. This, as I understand it, is the MAGA message.

As a side issue, I note that virtually every rapper is for Trump, and virtually every orthodox rabbi too. Yet the internationalist claim he’s racist. His approval among black voters is polled at 46%. Unless you hold that Jewish and black voters don’t understand their own interests. it would seem that Trump is not the racist he’s claimed to be. A recent, “jews for Trump” parade in NY was attacked with rocks, eggs, fists, and paint thrown on participants by white Democrats. The racists who run the NY Justice Department decided not to prosecute.

Robert Buxbaum, October 27-28, 2020. I figured it was time someone explained what “Make America Great Again” meant. I’ve also speculated on Trump’s religion here, and on his mental state, here.